An all-risk cargo insurance policy is the most comprehensive shipping insurance available. Any physical loss/damage from any external cause will be covered under this policy, and any exclusion not covered will be listed on the policy. These exclusions can be added to the policy as an additional clause. An annual open cargo policy automatically insures your shipments on set terms, conditions, and rates without the need to contact your insurance broker or company. Learn more about the different types of shipping insurance.

In regards to warehouse coverage, an annual all-risk shipping policy extends to goods temporarily stored during normal course of transit. However, if the goods are stored outside the normal course of transit, like an importer’s warehouse before shipment to customer, warehouse coverage must be added to insure the goods.

Contact a TRG Marine Specialist today about Warehouse Coverage or for answers to any of your Marine Cargo Insurance questions.

Domestic cargo insurance coverage pertains to goods on a bill of lading that were split during the normal course of transit and continued to separate end destinations.

When the terms of sale include insurance coverage up to the title transfer of goods, the buyer may purchase additional insurance from the provider known as a contingency policy. A contingency policy will provide insurance coverage for the goods once the title has transferred and the goods are no longer covered under the seller’s insurance policy. If goods are damaged upon arrival to the buyer and the title has transferred, the policy would pay the damage and the buyer’s insurance company would subrogate against the seller’s insurance. TRG Marine™ can write contingency policies.

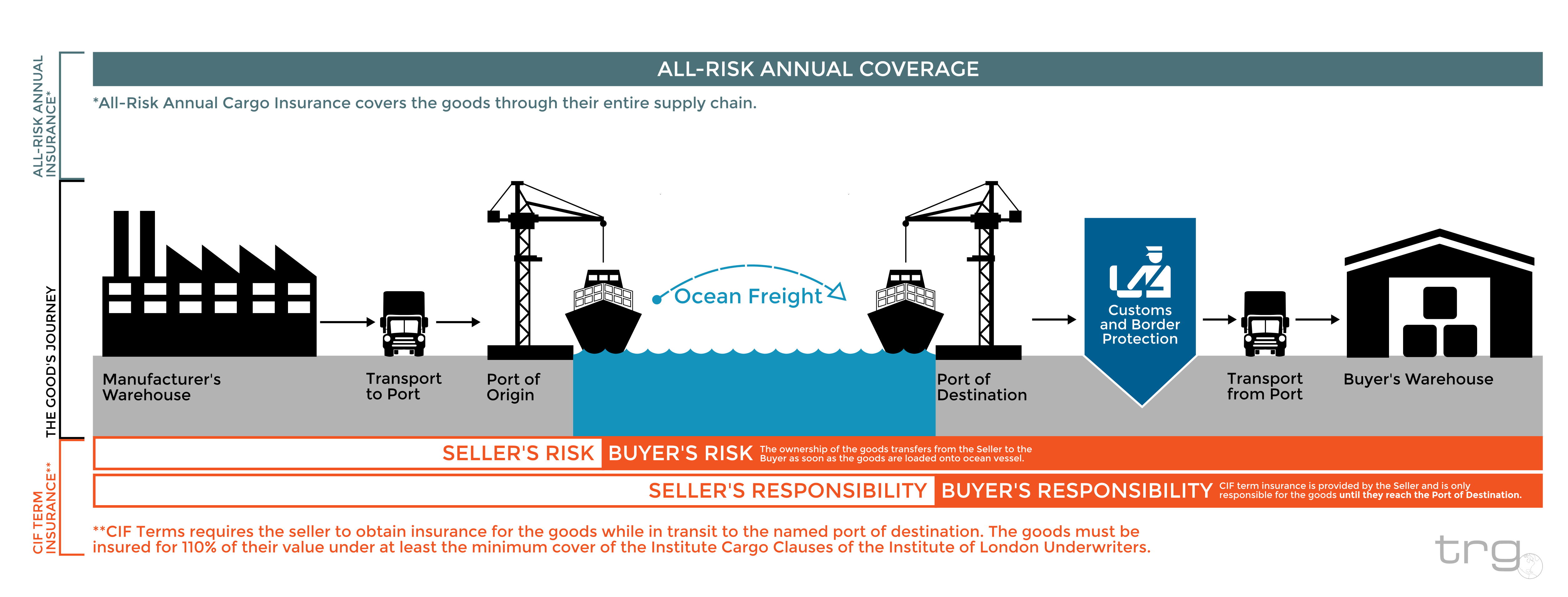

Basis of Valuation CIF + 10% or 110% Valuation means the standard valuation for both annual volume reporting and payment of cargo insurance claims, unless otherwise requested, is 110%. The total premium owed is calculated using the policy rate times 110% of the total cost of goods. Any covered losses are paid at 110% of the cost of goods, including freight and insurance premium of the shipment less deductible amount.

Watch our Marine Cargo Insurance webinar for a deeper look at why you need to be protected.

If you already have a cargo/shipping insurance policy, chances are it lacks the broad coverage that is offered by TRG Marine™. We negotiate very favorable terms with our cargo insurance carriers and would be pleased to offer you a free, no obligation comparison. By arranging cargo/shipping insurance in volume, our rates and terms are very competitive. Also, TRG Marine™ helps handle your claims and acts as your insurance department. Give us a try, again there’s no obligation and it’s free!

Contact a TRG Representative today about Marine Cargo Insurance for a free, no obligation quote.

Your transportation carrier will pay your losses only if you purchase specific cargo insurance from them, in these cases the coverage is provided. However, this coverage is usually insufficient and can end up costing you more, as they are not obligated to pay for your losses that occur beyond their control (such as in the case of a General Average Claim).

Also, international law limits the liability of ocean carriers to a minimum of $500 per package. Air carriers similarly limit their liability; truckers, rail carriers, and warehouse owners also limit their liability for loss according to their tariff.

You should consider changing because there are some major issues with buying on CIF terms. The first problem with buying on CIF terms is the importer has to deal with an overseas insurance company when a cargo insurance claim occurs.

Chances are you are not a valued client of that insurance company, and even if language barriers are not a problem, which they often are, it’s challenging getting the insurance company’s attention. Secondly, foreign insuring terms are frequently inferior to US terms. Also, if you sell goods C.& F, you have title and responsibility for the goods until they are loaded onto the ship or aircraft.

When you purchase through a freight forwarder often times the policy is on limited insuring terms (sometimes referred to as perils only) and isn’t sufficient for your needs. Also, in almost every case the premium rates are higher when acquired through your freight forwarder. These agencies typically mark up their rate for you to create an additional corridor for themselves. Keep in mind freight forwarders are logistics experts, not insurance experts, and cannot provide the best advice and services when it comes to your Marine Cargo Insurance. Furthermore, a freight forwarder’s house policy is generic because they handle a multitude of customers. At TRG Marine™ we are able to build a Marine Cargo Insurance Policy that will fit your needs and drastically reduce your costs.